Living on a budget doesn’t mean giving up on life’s pleasures—it means making smarter, more intentional choices and developing healthy habits that lead to greater financial freedom and peace of mind. Whether you’re saving for a dream vacation, building an emergency fund, paying off debt, or simply looking to get more value from your hard-earned money, budgeting is one of the most powerful tools at your disposal. It’s not about restriction—it’s about control. In this guide, we’ll explore practical, effective strategies to help you live on a budget while still enjoying life. With the right approach and healthy habits, living on a budget can empower you to achieve your goals and enjoy lasting financial peace.

Be Honest About Your Spending

The very first step to learn how to live on a budget effectively is to be completely honest about where your money goes. Many people underestimate or overlook small purchases like snacks, coffees, or subscription services, but these expenses add up quickly. Take a full week to track every single expense, no matter how small—even that daily $3 coffee or impulse buy. Writing down or using an app to record all your spending provides a clear picture of your habits and reveals where you might be wasting money. Remember, budgeting only works when it’s based on reality, not wishful thinking or assumptions.

Be Consistent: Track Every Dollar

Consistency is the backbone of any successful budget. To truly live on a budget, you need to track every dollar coming in and going out. Budgeting apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet can help you keep detailed records. By checking your expenses daily, you can identify patterns, cut back on unnecessary spending, and stay aligned with your financial goals. Keep your receipts—digital or paper—and make it a weekly habit to review them. This ongoing awareness makes it easier to stick to your budget plan and avoid surprises.

Stay Motivated with Clear Goals

Understanding why you want to live on a budget is crucial to maintaining motivation. Maybe you’re saving for a vacation, a new home, or simply want to become debt-free. Whatever your reason, keeping your goals front and center helps you stay focused. Create a vision board, set up milestone rewards, or use motivational reminders on your phone. For example, after saving $500, treat yourself to a small reward, like a $20 splurge on something fun. These positive reinforcements make budgeting feel less like a chore and more like a rewarding journey.

Plan for Occasional Expenses

Many people forget to budget for irregular but inevitable expenses such as birthday gifts, car insurance, or dental visits. Planning for these occasional costs is a vital part of learning to live on a budget wisely. Set up a “sinking fund” by putting aside a small amount each month specifically for these irregular expenses. This way, when these bills come due, you won’t have to dip into your emergency fund or rely on credit cards. Being proactive helps you avoid financial stress and keeps your budget intact.

Budget for Both Fixed and Variable Costs

When you’re figuring out how to live on a budget, it helps to categorize your expenses into fixed and variable costs. Fixed expenses like rent, insurance, and loan payments are consistent every month and generally non-negotiable. Variable costs such as groceries, utilities, and dining out fluctuate and offer more flexibility. By separating these two, you can better analyze where you might cut back. For instance, cooking at home more often instead of eating out or switching to energy-efficient appliances can reduce your variable costs significantly. The key is to recognize what you can control and adjust accordingly.

Cut Extra Spending

If your budget isn’t balanced, it’s time to trim the fat. To live on a budget effectively doesn’t mean eliminating all fun, but it does require evaluating and reducing unnecessary expenses. Take a close look at non-essential spending like daily coffees, fast food, or online shopping. Instead of dining out three times a week, try limiting it to once and cook at home the rest of the time. Pack lunches for work, which is often cheaper and healthier. Even saving just $5 a day on these small choices adds up to $150 a month—a meaningful contribution to your budget goals. Ask yourself regularly, “Do I need this, or do I just want it?” Being honest with yourself about your “wants” is critical when you want to live on a budget successfully.

Don’t Be Too Hard on Yourself

Budgeting is a journey, not a perfect science. Everyone slips up now and then. What matters is how you respond when you overspend. If you go over budget one week, adjust your spending the following week instead of giving up. Flexibility and forgiveness are key when you’re learning to live on a budget. Remember, this is about long-term financial stability, not a sprint to perfection. Treat yourself occasionally—maybe a small treat once a month—and balance is the goal, not deprivation.

Avoid Over-Deprivation

Much like extreme dieting, over-restricting your budget can lead to burnout. Sustainable budgeting includes room for small joys, whether it’s a fancy coffee once a week, fresh flowers, or a favorite hobby. Budgeting doesn’t mean you have to give up the pleasures of life; it means you plan for them responsibly. When you live on a budget that includes occasional indulgences, it becomes a lifestyle you can maintain long-term rather than a punishment you dread.

Review Your Budget Monthly

A budget isn’t set in stone. To effectively live on a budget, review your finances monthly. Life changes—new expenses, income shifts, or goals—mean your budget should evolve, too. Ask yourself: Are you staying on track? What worked? What didn’t? This regular review keeps your plan relevant and effective. By making adjustments as needed, you stay in control and prevent financial surprises.

Make Budgeting Enjoyable

Budgeting doesn’t have to be boring or stressful. Make it a fun, positive monthly event. Play your favorite music, enjoy a cup of tea, and involve your family or partner. Turning budgeting into a team activity can make it more enjoyable and increase accountability. When budgeting becomes a pleasant habit rather than a chore, it’s much easier to consistently live on a budget and reach your financial goals.

Bonus Tips for Smart Budgeting

Here are additional quick tips to help you live on a budget with confidence and ease:

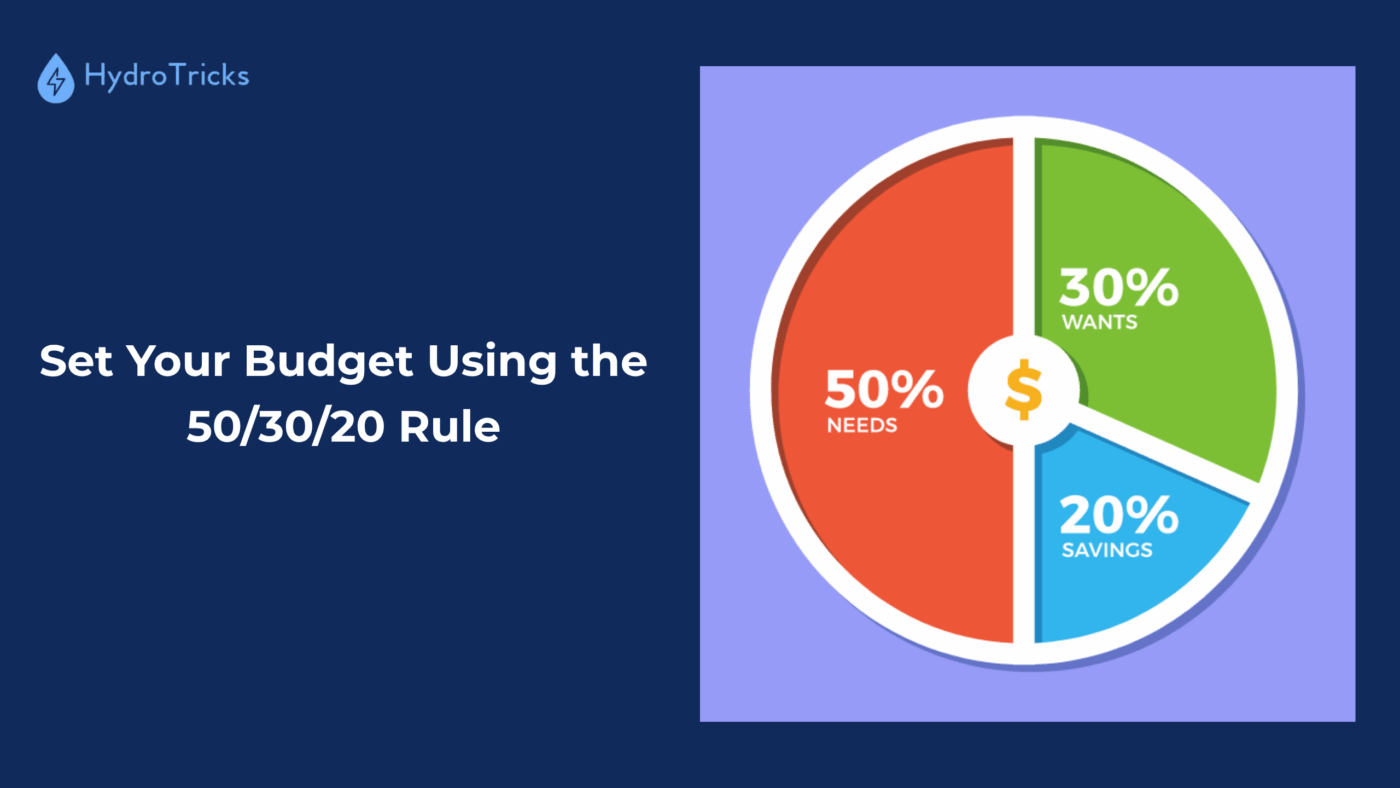

Set Your Budget Using the 50/30/20 Rule

- 50% for needs (housing, groceries, utilities)

- 30% for wants (entertainment, dining, travel)

- 20% for savings or debt repayment

Save Before You Spend

Treat savings like a non-negotiable bill. Automate the process so a set percentage of your income goes directly into a savings account as soon as you get paid. This makes saving effortless and consistent, helping you build a financial cushion over time.

Pay Down High-Interest Debt First

Prioritize paying off credit card balances or high-interest loans. Reducing these debts lowers the amount of interest you pay and eases financial stress, freeing up more money to save or spend wisely later.

Use Cash or Debit

Paying with cash or a debit card helps you feel the “pain” of spending and encourages mindfulness.

Plan Large Purchases in Advance

Avoid impulse buying. If you want something expensive, wait a few days. Chances are you’ll reconsider or find a better deal.

Wait for Sales

Take advantage of seasonal sales, coupons, and cashback apps. Never pay full price if you don’t have to.

Ask for Discounts

Whether you’re at a local market or buying electronics, it never hurts to ask for a better price. You’d be surprised how often it works.

Conclusion: Your Budget, Your Power

Learning to live on a budget doesn’t mean giving up joy or missing out on the things that make life meaningful—it means equipping yourself with the tools and habits to thrive every day. With consistency, awareness, and a little thoughtful planning, you can stretch your income further while still enjoying a fulfilling and fun lifestyle. The key is to start with honesty about your spending, keep your financial goals clearly in focus, and review your progress regularly to stay on track. When you commit to smart budgeting strategies and maintain a positive mindset, you’ll discover that it’s entirely possible to live on a budget and truly love the life you’re building.

FAQs

How do I budget on a variable income?

Use your average monthly income and prioritize essential expenses first. Base your budget on the lowest income month from the past 6 months.

What if I have a lot of debt?

Focus on the snowball (smallest balance first) or avalanche (highest interest first) methods to pay off debt while maintaining essential expenses.

Can I still enjoy life on a budget?

Absolutely! Budgeting isn’t about restriction. It’s about empowerment and prioritization.

Do budgeting apps really help?

Yes, especially if you’re new to budgeting. Apps automate the tracking and help visualize your spending.

What’s the best way to get started if I’ve never budgeted before?

Start by tracking every expense for a month. Identify your needs versus wants, and then build your budget around those insights.